$100,000 allocated to GCSU’s new student-managed investment fund

T

he Georgia College & State University Foundation allocated $100,000 to a new club, the GCSU Student Managed Investments Committee.

Led by five leadership board members, the new student group will complete internal analysis and pitch ideas for investing their fund to Georgia College’s Foundation Board of Trustees and the Finance and Investment Committee.

“We are proud to make an investment in these students that will result in giving them workforce skills in a competitive market,” said Foundation Board Chair Jeff Wansley. “We are enthusiastic about investing in the potential of our students and envisioning them as future contributors to our mission.”

The Student Managed Investment Committee rose from the work of sophomore finance and economics major Jeffrey DiBenedetto of Johns Creek, Georgia. A student initiative from the beginning, DiBenedetto enlisted the help of Dr. Brent Evans, associate professor of economics and Dr. Eric Kobbe, lecturer of management information systems.

“I’m really excited about the opportunity it creates to take down some of the barriers that come from trying to get students into investing their money,” Evans said. “This is something we should be proud of, and I suspect the benefits will become more obvious over time. I think for the students, it creates opportunities for them to take ownership of something.”

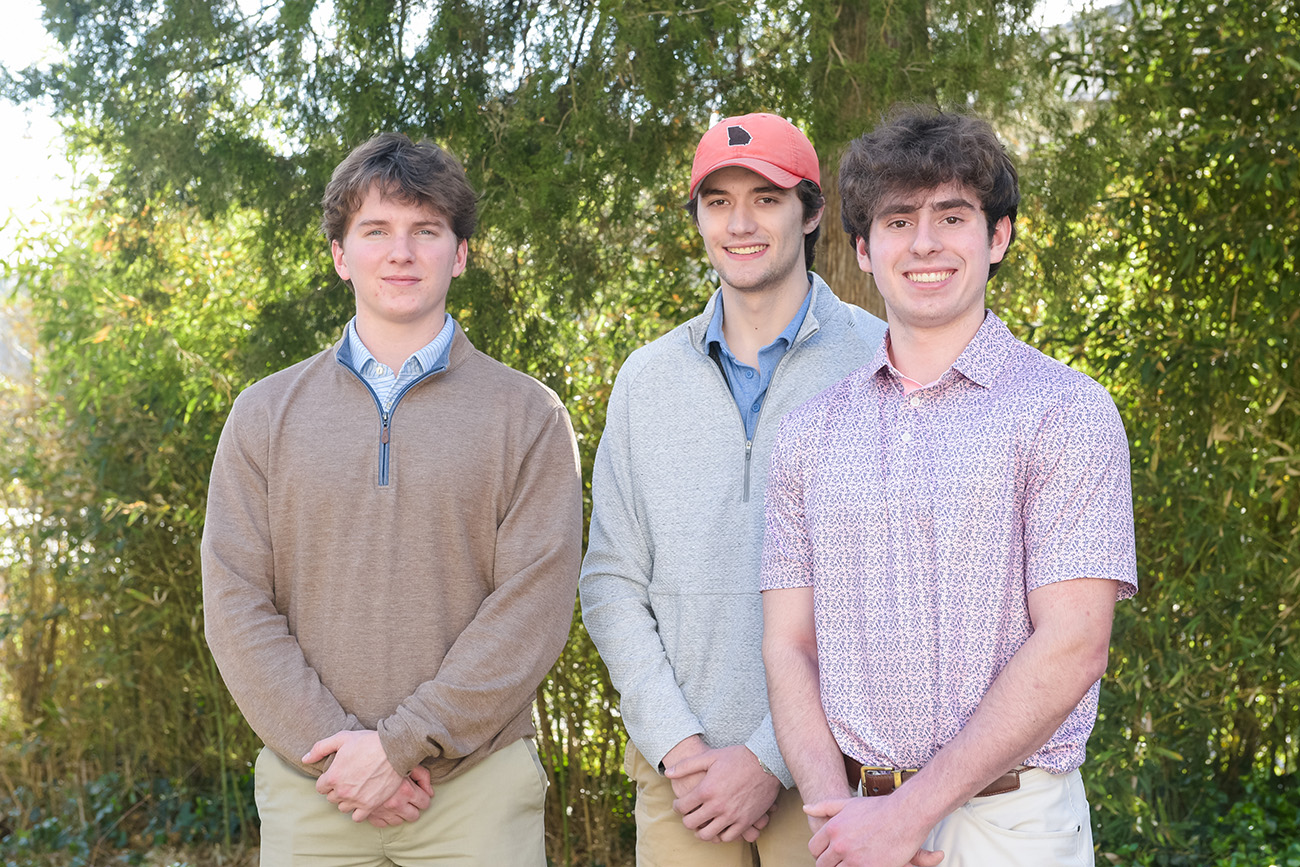

With Evans and Kobbe’s help, DiBenedetto recruited four more students to join him on the committee’s leadership board: senior finance and economics double-major Grayson Stoudenmire of Maxeys, Georgia; junior finance and economics double-major Joseph Dubsky of Dunwoody, Georgia; sophomore business management and mass communication double-major Halle Bergstrom of Cumming, Georgia; and sophomore finance major Whit Kessinger of Roswell, Georgia.

These students serve as president, vice president of sectors, vice president of finance, vice president of public relations and vice president of recruiting, respectively.

“Dean Micheal Stratton [of the College of Business and Technology] was on board with it immediately, and he loved the initiative we took,” DiBenedetto said. “To us, it’s more than a club—our goal is to make it big. $100,000 is a great starting place, but I want to see this grow to a million dollars in 10 years, or more.”

They will oversee a group of 10 managing directors representing the S&P 500’s sectors, with materials and utilities combined. Each director will lead a group of three to four analysts, 35 students in total, who will perform financial analysis and valuation of their sector’s companies.

Each team will present to the Student Managed Investments Committee, who will confirm or deny their pitches. The leadership board will then present successful pitches to the governance overseeing the fund.

"The Student Managed Investments Committee dovetails perfectly with the new Finance major, which has quickly become one of the largest majors within the GCSU College of Business and Technology," said Vice President for Advancement Seth Walker.

The new committee’s progress will be reported on their LinkedIn page, GCSU Student Managed Investments Committee (SMIC). All proceeds from the Student Managed Investments Committee’s work benefits the Georgia College Foundation.

“It’s a great feeling to be entrusted with this much responsibility,” Stoudenmire said. “But once we showed both the drive to get it done, and that we have some degree of competence, they really allowed us to create it.”